Best CRM For Financial Services: Enhancing Efficiency And Customer Relations

Best CRM for Financial Services takes center stage as organizations seek to streamline operations and improve client interactions. This comprehensive guide delves into the key aspects of implementing a CRM system tailored for the financial industry, offering valuable insights and strategies for success.

From security and compliance to integration capabilities and industry-specific features, this exploration of CRM solutions in the financial sector provides a holistic view of how technology can drive growth and enhance customer satisfaction.

Overview of CRM for Financial Services

Customer Relationship Management (CRM) is crucial in the financial services industry as it allows organizations to effectively manage interactions with clients, streamline processes, and increase overall efficiency. CRM systems help financial institutions build and maintain strong relationships with customers, leading to improved customer satisfaction and retention.

Key Features of CRM System for Financial Services

- Integration with financial tools: A CRM system for financial services should seamlessly integrate with banking, investment, and accounting software to provide a comprehensive view of customer data.

- Regulatory compliance: Given the highly regulated nature of the financial industry, a CRM system should have robust security measures and compliance capabilities to ensure data protection and adherence to regulations.

- Customization for financial products: The ability to tailor the CRM system to specific financial products and services offered by the institution is essential for effective customer engagement and sales.

- Analytics and reporting: Advanced analytics and reporting features enable financial institutions to gain insights into customer behavior, track performance metrics, and make data-driven decisions.

CRM Systems Tailored for Financial Services vs. General CRM Solutions

CRM systems tailored for financial services offer specialized features designed to meet the unique needs and challenges of the industry. These systems provide deeper integrations with financial tools, enhanced security measures, and customization options specific to financial products. On the other hand, general CRM solutions may lack the industry-specific functionalities required by financial institutions and may not offer the same level of compliance and regulatory support.

Security and Compliance

When it comes to CRM systems in financial services, security and compliance are of utmost importance to protect sensitive data and ensure regulatory requirements are met.

Security Measures

- Encryption of data at rest and in transit to prevent unauthorized access.

- Role-based access control to limit user permissions based on their roles within the organization.

- Regular security audits and penetration testing to identify and address any vulnerabilities.

- Implementing multi-factor authentication to add an extra layer of security for user logins.

Compliance Requirements

- GDPR (General Data Protection Regulation): Ensuring that personal data is processed lawfully, transparently, and for a specific purpose.

- CCPA (California Consumer Privacy Act): Providing consumers with more control over their personal information and how it is used by organizations.

- Industry-specific regulations: Compliance with regulations such as SEC, FINRA, or PCI DSS based on the type of financial services being offered.

Data Protection and Privacy in CRM Systems

- Implementing data masking techniques to protect sensitive information such as social security numbers or credit card details.

- Regularly updating security patches and software to address any known vulnerabilities.

- Providing users with the ability to review and update their consent preferences for data usage.

- Ensuring data is stored in secure servers with backups to prevent data loss in case of system failures.

Integration Capabilities

Integrating a CRM system with other financial software is essential for optimizing processes and enhancing efficiency in financial services. By seamlessly connecting CRM with accounting or portfolio management systems, businesses can streamline workflows and ensure a smooth flow of data across platforms.

Integration with Accounting Software

One of the key integration options for CRM in financial services is with accounting software. This integration enables financial advisors and professionals to access client financial data and transactions directly within the CRM system. By syncing customer information with accounting records, advisors can provide personalized recommendations and insights based on real-time financial data.

Integration with Portfolio Management Systems

CRM integration with portfolio management systems allows financial services firms to consolidate client information, investment portfolios, and performance reports in one centralized platform. This unified view enables advisors to track client investments, monitor market trends, and make informed decisions to optimize client portfolios.

Benefits of Seamless Data Flow

Seamless data flow between CRM and other financial platforms offers numerous benefits, including improved data accuracy, enhanced client communication, and increased operational efficiency. By eliminating manual data entry and ensuring data consistency across systems, financial services firms can deliver better customer service, drive business growth, and maintain compliance with industry regulations.

Customization and Flexibility

Customizing CRM systems in the healthcare industry is crucial as it allows organizations to tailor the software to meet specific needs and challenges unique to the sector. By customizing CRM solutions, healthcare providers can improve patient care, enhance communication, and streamline processes efficiently.

Examples of Customization in Healthcare CRM

- Personalizing patient profiles to include medical history, treatment plans, and appointments for better care coordination.

- Implementing automated appointment reminders and follow-up communications to boost patient engagement and adherence to treatment plans.

- Integrating telehealth capabilities for virtual consultations and remote monitoring to expand access to care and improve patient outcomes.

Customization Options in CRM Platforms

- Customizable dashboards and reports for tracking key performance indicators and patient outcomes.

- Workflow automation to streamline administrative tasks and improve operational efficiency.

- Integration with electronic health records (EHR) systems for seamless data sharing and enhanced care coordination.

Data Security and Compliance

Data security plays a critical role in cloud-based CRM systems for legal firms, where confidentiality and client privacy are paramount. Compliance features in CRM solutions help legal professionals adhere to regulations and maintain trust with clients by safeguarding sensitive information effectively.

Role of Data Security in Legal CRM

- Encryption of data at rest and in transit to protect confidential client information from unauthorized access.

- Role-based access controls to ensure that only authorized personnel can view or modify sensitive data within the CRM system.

- Regular security audits and compliance checks to identify vulnerabilities and ensure adherence to industry standards and regulations.

Ensuring Compliance in Legal CRM

- Implementing data retention policies to manage and dispose of client data securely in compliance with legal requirements.

- Providing training to staff on data protection best practices and regulatory guidelines to mitigate the risk of data breaches.

- Monitoring and logging user activities within the CRM system to track access to sensitive information and detect any unauthorized or suspicious behavior.

Integration and Automation

Integrating CRM systems with e-commerce platforms offers significant benefits for retail businesses by providing a unified view of customer data and enabling personalized marketing strategies. Automation features in CRM software streamline customer interactions, order processing, and inventory management to enhance operational efficiency and drive sales growth.

Benefits of CRM-E-commerce Integration

- Seamless synchronization of customer information, purchase history, and preferences between CRM and e-commerce platforms for targeted marketing campaigns.

- Automated order processing and tracking to improve fulfillment speed and customer satisfaction.

- Inventory management integration to optimize stock levels, prevent stockouts, and streamline supply chain operations.

Automation in CRM for Retail

- Automated email marketing campaigns triggered by customer behavior or purchase patterns to increase engagement and drive repeat sales.

- AI-powered chatbots for real-time customer support and order inquiries, enhancing the shopping experience and reducing response times.

- Integration with social media platforms for targeted advertising, customer engagement, and lead generation to expand the customer base and boost sales revenue.

Customer Relationship Management

Customer Relationship Management (CRM) systems play a crucial role in helping financial institutions effectively manage client relationships. These systems provide a centralized platform for storing customer data, interactions, and preferences, allowing financial professionals to have a comprehensive view of each client.

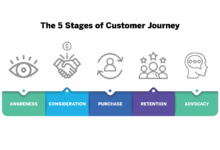

Utilizing CRM Data for Customer Experience and Retention

CRM data can be leveraged to enhance customer experience and improve retention rates. By analyzing customer interactions, preferences, and feedback stored in the CRM system, financial institutions can personalize their services and communication. Strategies such as targeted marketing campaigns, personalized recommendations, and proactive customer service based on CRM insights can lead to higher customer satisfaction and loyalty.

- Personalized Communication: CRM systems enable financial institutions to tailor communication based on customer preferences and behaviors, resulting in more relevant and engaging interactions.

- Targeted Marketing: By segmenting customers based on CRM data, financial institutions can create targeted marketing campaigns that resonate with specific customer groups, increasing the effectiveness of their marketing efforts.

Key Performance Indicators (KPIs) Tracked Using CRM Systems

In the financial sector, key performance indicators (KPIs) tracked using CRM systems include customer acquisition cost, customer lifetime value, customer retention rate, cross-selling and upselling opportunities, and customer satisfaction scores. These metrics provide valuable insights into the overall performance of the institution and help in making data-driven decisions to improve customer relationships.

- Customer Acquisition Cost: The cost incurred to acquire a new customer, calculated by dividing total marketing and sales expenses by the number of new customers acquired.

- Customer Lifetime Value: The predicted revenue a customer will generate over their entire relationship with the institution, helping in determining the value of retaining customers.

- Customer Retention Rate: The percentage of customers who continue to do business with the institution over a specific period, indicating customer loyalty and satisfaction.

Data Security and CRM Implementation

Data security and privacy measures are paramount when implementing CRM systems in financial institutions. Safeguarding customer data from cyber threats and ensuring compliance with regulations such as GDPR and CCPA are essential to maintaining trust and credibility with clients. Encryption, access controls, regular security audits, and staff training on data protection practices are crucial components of a secure CRM implementation.

Integration of CRM Systems with AI and Big Data Analytics

Integrating CRM systems with technologies such as Artificial Intelligence (AI) and Big Data Analytics enhances customer insights and enables predictive analytics for personalized offerings. AI algorithms can analyze vast amounts of data stored in the CRM system to identify patterns, predict customer behavior, and automate personalized recommendations. Big Data Analytics tools help in processing and analyzing large datasets to extract valuable insights that can drive targeted marketing strategies and improve overall customer satisfaction.

Reporting and Analytics

In the realm of financial services, reporting and analytics play a crucial role in understanding customer behavior, identifying trends, and making informed business decisions based on data-driven insights.

Reporting Capabilities of CRM Systems

- CRM systems for financial services offer robust reporting capabilities that allow businesses to track key performance indicators (KPIs) such as customer acquisition cost, customer lifetime value, and conversion rates.

- These systems can generate detailed reports on sales performance, marketing campaigns, customer interactions, and more, providing a comprehensive view of the business’s operations.

Examples of Key Performance Indicators (KPIs)

- Customer retention rate

- Lead conversion rate

- Average deal size

- Customer satisfaction score

Data Insights and Business Decisions

- By leveraging data insights from CRM analytics, financial services firms can make strategic business decisions, optimize marketing strategies, and enhance customer engagement.

- These insights enable businesses to personalize their offerings, improve customer service, and drive revenue growth by targeting high-value customers effectively.

Creating Custom Reports

- Financial services firms can create custom reports in CRM systems by selecting relevant data fields, setting filters, and defining report parameters to meet specific business requirements.

- Custom reports can be tailored to track financial metrics, monitor sales performance, and analyze customer behavior, providing actionable insights for decision-making.

Setting Up Automated Reports

- Setting up automated reports in CRM for financial analysis involves scheduling report generation at regular intervals, specifying recipients, and defining delivery preferences to ensure timely access to critical business data.

- Automated reports can streamline data analysis processes, improve decision-making efficiency, and enable real-time monitoring of key business metrics.

Interpreting CRM Analytics Data

- Interpreting CRM analytics data to improve sales performance requires analyzing trends, identifying patterns, and uncovering insights that can drive strategic sales initiatives and enhance customer relationships.

- Financial services firms can use CRM analytics data to identify cross-selling opportunities, forecast sales projections, and optimize sales strategies to maximize revenue generation.

Importance of Data Visualization Tools

- Data visualization tools play a critical role in presenting CRM analytics reports effectively by transforming complex data sets into interactive charts, graphs, and dashboards that facilitate data interpretation and decision-making.

- Visual representations of CRM analytics data enhance data visibility, improve data-driven communication, and empower users to extract actionable insights from data analysis for informed decision-making.

Mobile Accessibility

In today’s fast-paced world, mobile accessibility has become increasingly important for financial services professionals who need to access client information on the go. Mobile CRM applications enable professionals to stay connected and provide timely services to clients, ultimately enhancing customer relationships.

Importance of Mobile CRM Applications

- Access to real-time client information: Mobile CRM apps allow professionals to access client data anytime, anywhere, ensuring they have the latest information at their fingertips.

- Improved efficiency and productivity: With mobile access to CRM systems, professionals can respond to client inquiries promptly and work more efficiently while on the move.

- Enhanced customer service: Being able to access client information quickly and efficiently enables professionals to provide personalized and timely services, ultimately improving customer satisfaction.

Security Considerations

- Secure access: It is crucial to ensure that mobile CRM applications have robust security measures in place, such as encryption and multi-factor authentication, to protect sensitive client data.

- Remote data wipe: In case a mobile device is lost or stolen, the CRM app should have the capability to remotely wipe data to prevent unauthorized access to client information.

- Regular updates: It is important to regularly update the mobile CRM app to patch any security vulnerabilities and ensure data protection.

Scalability and Growth

CRM systems play a crucial role in supporting the growth of financial services firms by providing scalability to accommodate expanding operations and customer base.

Challenges of Scaling CRM Solutions

- Increased Data Volume: As the business grows, the amount of customer data and interactions also increases, putting a strain on CRM systems.

- Performance Issues: Scaling up can lead to slower system performance if not properly managed, impacting user experience and productivity.

- Integration Complexity: Integrating CRM with other systems and applications becomes more challenging as the business expands, requiring seamless data flow.

Overcoming Scalability Challenges

- Cloud-Based Solutions: Leveraging cloud-based CRM allows for easy scalability without the need for additional hardware or infrastructure upgrades.

- Modular Approach: Implementing CRM in modular components enables gradual expansion and customization to meet evolving business needs.

- Data Management: Implementing effective data management strategies ensures that CRM systems can handle growing data volumes efficiently.

Successful CRM Implementations for Business Growth

- Bank of America: Utilized CRM to consolidate customer data and interactions across multiple channels, enabling personalized services and driving customer growth.

- JPMorgan Chase: Implemented CRM to streamline customer onboarding processes, leading to improved efficiency, reduced costs, and increased customer satisfaction.

- Ameriprise Financial: Integrated CRM with financial planning tools to provide advisors with a comprehensive view of client portfolios, enhancing service delivery and driving business growth.

Training and Support

Training programs and ongoing support are crucial aspects of successfully implementing a CRM system in the financial services industry. Without proper training, staff may struggle to utilize the system effectively, leading to inefficiencies and missed opportunities. Additionally, ongoing support and maintenance ensure that the CRM platform continues to meet the evolving needs of the organization.

Training Programs

Many CRM vendors offer a variety of training programs to help staff members learn how to use the system efficiently. These programs may include onsite training, online training modules, video tutorials, and documentation. The goal is to ensure that all users are familiar with the features and functionalities of the CRM system.

Importance of Ongoing Support

Continuous support and maintenance are essential for the long-term success of a CRM platform. As the needs of the organization change and new updates are released, ongoing support ensures that the system remains up-to-date and aligned with business objectives. This support can come in the form of technical assistance, troubleshooting, and regular system updates.

Examples of CRM Vendors with Strong Support Services

- Salesforce: Known for its comprehensive training programs and extensive support resources, including a robust online community and dedicated customer support teams.

- Microsoft Dynamics 365: Offers a range of training options, from instructor-led courses to self-paced learning modules, as well as 24/7 technical support.

- HubSpot CRM: Provides personalized onboarding support, ongoing training webinars, and a knowledge base for self-help resources.

Comparison Table of Training Options

| CRM Vendor | Training Programs | Ongoing Support |

|---|---|---|

| Salesforce | Onsite training, online modules, video tutorials | 24/7 customer support, extensive online resources |

| Microsoft Dynamics 365 | Instructor-led courses, self-paced learning | 24/7 technical support, regular updates |

| HubSpot CRM | Personalized onboarding, training webinars | Knowledge base, ongoing support |

Role of User Feedback in Training Programs

User feedback plays a crucial role in shaping training programs for CRM systems. By listening to users’ experiences and challenges, CRM vendors can tailor their training materials to address common pain points and improve user adoption. Incorporating feedback into training programs ensures that users receive the support they need to maximize the benefits of the CRM platform.

Industry-specific Features

In the financial services industry, CRM systems offer unique features tailored to the specific needs of banks, insurance companies, and other financial institutions. These industry-specific functionalities provide significant benefits in terms of customer relationship management, compliance with regulations, and overall operational efficiency.

CRM Tools for Financial Institutions

- One example of a CRM tool that excels in providing solutions tailored to financial institutions is Salesforce Financial Services Cloud. This platform offers features such as portfolio tracking, financial goal management, and wealth management capabilities.

- Another notable CRM tool for financial services is Microsoft Dynamics 365 for Finance and Operations. This platform integrates seamlessly with other Microsoft products, offering a comprehensive solution for customer relationship management in the financial sector.

Compliance with Financial Regulations

CRM systems can assist financial institutions in compliance with regulations by providing tools for data security, audit trails, and regulatory reporting.

CRM Features for Banking Institutions vs. Insurance Companies

- CRM features designed for banking institutions often focus on customer onboarding, loan management, and risk assessment.

- On the other hand, CRM features for insurance companies may emphasize policy management, claims processing, and underwriting.

Key Performance Indicators (KPIs) in CRM for Financial Sector

| KPI | Description |

|---|---|

| Customer Lifetime Value (CLV) | Measure of the total revenue a company expects to earn from a customer throughout their entire relationship. |

| Customer Retention Rate | Percentage of customers that a company retains over a specific period. |

| Lead Conversion Rate | Percentage of leads that convert into customers. |

| Net Promoter Score (NPS) | Measure of customer loyalty and satisfaction based on the likelihood of customers to recommend a company. |

Case Studies and Success Stories

Implementing CRM systems in financial services firms has led to numerous success stories and positive outcomes. These real-life examples showcase the tangible benefits of utilizing CRM in the industry.

Operational Efficiency and Client Satisfaction

- One financial institution saw a significant improvement in operational efficiency after implementing a CRM system. By centralizing client data and streamlining communication processes, the firm was able to reduce manual tasks and improve response times.

- Another case study highlighted how a CRM solution enhanced client satisfaction by providing personalized service and targeted marketing campaigns. By leveraging CRM data, the firm could tailor offerings to individual clients’ needs and preferences.

ROI Metrics and Performance Improvements

- A detailed analysis of ROI metrics revealed that financial services firms experienced a notable increase in revenue and client retention rates post-CRM implementation. The ability to track and analyze customer interactions resulted in higher conversion rates and improved cross-selling opportunities.

- Performance improvements such as faster lead response times, higher customer engagement levels, and improved sales forecasting were directly attributed to the use of CRM systems in the financial sector.

Successful CRM Integration Process

- A successful CRM integration in a financial institution involved thorough planning, stakeholder buy-in, and comprehensive training programs. The implementation process included data migration, customization of workflows, and ongoing support to ensure smooth adoption and utilization of the CRM platform.

- By aligning the CRM system with the organization’s specific goals and requirements, the financial institution was able to maximize the benefits of the technology and drive positive outcomes across the business.

Challenges Faced by Small and Large Firms

- Small financial services firms often encounter budget constraints and resource limitations when adopting CRM solutions. In contrast, large firms face challenges related to organizational complexity, legacy systems integration, and change management processes.

- Despite the differences in challenges, both small and large financial institutions can leverage CRM systems to enhance customer relationships, improve operational efficiency, and drive growth in a competitive market.

Personalized Customer Interactions

- Personalized customer interactions play a crucial role in CRM success stories within the financial sector. By utilizing CRM data to tailor communications, offers, and services, financial firms can build stronger relationships with clients and increase customer loyalty.

- Case studies have shown that personalized customer interactions result in higher conversion rates, increased customer lifetime value, and improved brand reputation for financial services firms.

Impact of Mobile CRM Applications

- A case study illustrating the impact of mobile CRM applications on a financial services firm revealed a significant boost in productivity and customer engagement. Mobile access to CRM data allowed employees to respond quickly to client inquiries, access real-time information, and collaborate more effectively.

- The implementation of mobile CRM applications led to improved sales performance, enhanced customer service levels, and greater flexibility in managing client relationships for the financial institution.

Customization for Unique Needs

- Customizing CRM platforms to meet the unique needs of different financial services companies involves understanding specific business requirements, defining key performance indicators, and tailoring the system architecture to align with organizational goals.

- By customizing CRM features, workflows, and reports, financial institutions can address industry-specific challenges, comply with regulatory requirements, and drive innovation in client service delivery.

Cost and ROI Analysis

Implementing a CRM system in the financial services sector involves various costs that need to be considered for an accurate ROI analysis. Factors influencing the return on investment of CRM investments in this sector play a crucial role in determining the value proposition of different CRM vendors.

Breakdown of Costs

- Initial setup and implementation costs, including software licenses and customization fees.

- Training costs for employees to ensure effective utilization of the CRM system.

- Maintenance and support costs for ongoing system updates and troubleshooting.

- Integration costs with existing systems and data migration expenses.

- Potential costs for additional features, modules, or upgrades as the business grows.

Factors Influencing ROI

- The ability of the CRM system to streamline processes and improve efficiency in customer interactions.

- Enhanced data analytics and reporting capabilities leading to better decision-making and customer insights.

- Increased customer retention and acquisition through personalized and targeted marketing strategies.

- Improved collaboration and communication within the organization for better customer service.

- Reduction in operational costs and time savings due to automation and workflow optimization.

Comparison of Pricing Models

- Subscription-based models with monthly or annual fees, offering scalability and flexibility.

- Perpetual licensing models with one-time payments but potential additional costs for upgrades and support.

- Usage-based pricing models where costs are determined by the number of users or transactions processed.

- Value-based pricing models that align costs with the perceived value and benefits delivered by the CRM system.

Future Trends in CRM for Financial Services

The future of CRM in the financial services industry is constantly evolving, driven by emerging technologies and changing customer expectations. Let’s explore some key trends shaping the future of CRM for financial services.

AI-driven Insights and Automation

AI-driven insights and automation are expected to play a significant role in the future of CRM for financial services. By leveraging artificial intelligence and machine learning algorithms, financial institutions can gain valuable insights into customer behavior, preferences, and needs. Automation of routine tasks can streamline processes, improve efficiency, and enhance the overall customer experience.

- AI-powered chatbots for personalized customer interactions

- Automated lead scoring and predictive analytics for targeted marketing

- Machine learning algorithms for fraud detection and risk management

Blockchain Integration

Blockchain technology has the potential to revolutionize CRM for financial services by enhancing security, transparency, and data integrity. Integrating blockchain into CRM systems can enable secure and immutable record-keeping, streamline transactions, and improve trust between financial institutions and their customers.

- Smart contracts for automated and secure transactions

- Decentralized identity management for enhanced data protection

- Blockchain-based loyalty programs for customer engagement

Personalized Customer Experiences

Personalization is key to the future of CRM in financial services. By leveraging data analytics and AI-driven insights, financial institutions can deliver highly personalized experiences tailored to individual customer needs and preferences. Personalization not only enhances customer satisfaction but also fosters long-term loyalty and trust.

- Customized product recommendations based on customer behavior

- Personalized communication channels for targeted marketing campaigns

- Dynamic pricing strategies based on customer segmentation

Data Analytics and Cybersecurity

Data analytics will continue to play a crucial role in enhancing customer relationship management within the financial sector. By analyzing vast amounts of customer data, financial institutions can gain valuable insights, identify trends, and make informed decisions to better serve their customers. Additionally, cybersecurity measures are essential to safeguard customer data and maintain trust in CRM systems for financial institutions.

- Advanced analytics for customer segmentation and predictive modeling

- Real-time data monitoring for fraud detection and risk mitigation

- Encryption and multi-factor authentication for enhanced data security

CRM Strategies in Traditional Banks vs Online Platforms

The implementation of CRM strategies differs between traditional banks and online financial services platforms. While traditional banks may focus on in-person interactions and relationship building, online platforms prioritize digital engagement and seamless customer experiences. Understanding these differences and adapting CRM strategies accordingly is crucial for success in the evolving financial services landscape.

- Omni-channel customer engagement for seamless interactions

- Personalized digital experiences tailored to online user behavior

- Integration of CRM systems with digital banking platforms for holistic customer insights

Summary

In conclusion, Best CRM for Financial Services is not just a tool but a strategic asset for financial institutions looking to stay competitive in a rapidly evolving market. By leveraging the right CRM system, organizations can unlock new opportunities, improve operational efficiency, and foster stronger client relationships.